UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No.)No._)

Filed by the Registrantþ ☒

Filed by a Party other than the Registrant¨ ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

RigNet, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

RIGNET, INC

1880 S. Dairy AshfordNOTICE OF

2015 ANNUAL MEETING

OF STOCKHOLDERS

| Time and Date: | 10:00 a.m. Central Daylight Time, May 8, 2015 |

| Location: | RAC Conference Center – Washington Room |

| 1880 S. Dairy Ashford, Ashford Crossing II, Suite 220, Houston, Texas 77077 |

Suite 300

Houston, Texas 77077

(281) 674-0100

March 26, 201425, 2015

Dear Stockholder:

You are cordially invited to attend the 20142015 Annual Meeting of Stockholders of RigNet, Inc. (the “Company” or “RigNet”), which will be held at 10:00 a.m., Central Daylight Time, on Friday, May 9, 20148, 2015 at RigNet’s corporate office atRAC Conference Center – Washington Room, 1880 S. Dairy Ashford, Ashford Crossing II, Suite 300,220, Houston, Texas 77077. Following a report on RigNet’s business operations, stockholders will vote to:

Whether or not

| Elect the nine directors named in our proxy statement to serve until the 2016 Annual Meeting of Stockholders or until their respective successors have been elected; |

| Ratify the selection of Deloitte & Touche LLP as our independent auditors for 2015; and |

| Approve our named executive officers’ compensation as a non-binding advisory vote. |

Stockholders will also consider any other business as may properly come before the Annual Meeting.

You are eligible to vote if you plan to attendwere a stockholder of record at the annual meeting, it is importantclose of business on March 20, 2015. Please ensure that your shares beare represented and voted at the meeting. We encourage you to votemeeting by promptly voting and submitting your shares according to the instructionsproxy on the Internet or by completing, signing, dating and returning your proxy card in the enclosed proxy card.envelope. If you decide to attend the meeting and vote, you may withdraw your proxy at that time.

This year you will be asked to vote in favor of the election of nine directors; in favor of ratifying the appointment of Deloitte & Touche LLP as the Company’s external auditors; and in favor, as an advisory vote, of the compensation of named executive officers.

To assist you in voting your shares, in addition to this Notice of Annual Meeting, you will find enclosed the Notice of Annual Meeting, the 20142015 Proxy Statement and our 20132014 Annual Report to Stockholders, which includes the Company’s audited financial statements.

On behalf of the Board of Directors and employees of RigNet, we thank you for your continued interest in and support of the Company.

Sincerely,

| Sincerely, | |||

| |||

|

Your vote is important. Please vote promptly.

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 9, 2014

Dear Stockholder:

You are cordially invited to attend the 2014 Annual Meeting of Stockholders (the “Annual Meeting”) of RigNet, Inc., a Delaware corporation (“RigNet”), which will be held on Friday, May 9, 2014 at 10:00 a.m., Central Daylight Time, at RigNet’s corporate office at 1880 S. Dairy Ashford, Suite 300, Houston, Texas 77077. The Annual Meeting will be held for the following purposes:

Additional information regarding the Annual Meeting is set forth in the attached proxy statement.

Only stockholders of record at the close of business on March 21, 2014 are entitled to receive notice of and to vote at the Annual Meeting or any adjournments or postponement thereof. A list of our stockholders will be available for examination at the Annual Meeting and at RigNet’s corporate office in Houston at least ten days prior to the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please cast your vote, as instructed in the Proxy Materials and the Proxy Card sent to you, as promptly as possible.

| /s/ William D. Sutton | |||

James H. Browning | William D. Sutton | ||

| Chairman of the Board | Senior Vice President, General Counsel and | ||

| Corporate Secretary | |||

Houston, Texas

March 26, 2014

Important Notice Regarding Availability of Proxy Materials for RigNet, Inc.’s

Stockholder Meeting to be Held on May 9, 2014:

ourOur Proxy Statement and Annual Report to Stockholders are available at

“https://materials.proxyvote.com/766582”.

Your vote is important. Please vote promptly.

You may vote according to

| i |

This summary highlights information contained elsewhere in the instructionsproxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

on the enclosed Proxy Card.

RIGNET INC.

PROXY STATEMENT FOR 20142015 ANNUAL MEETING OF STOCKHOLDERS

| Time and Date: | 10:00 a.m. Central Daylight Time, May 8, 2015 |

| Location: | RAC Conference Center – Washington Room |

| 1880 S. Dairy Ashford, Ashford Crossing II, Suite 220, Houston, Texas 77077 |

TABLE OF CONTENTSVoting. Stockholders as of the record date, March 20, 2015, are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals on which to be voted.

Each stockholder’s vote is important. Even if you plan to attend our Annual Meeting in person, please cast your vote as soon as possible by:

| using the Internet at “https://materials.proxyvote.com/766582 |  | mailing your signed proxy or voting instruction form |

Attendance. RigNet stockholders as of the record date are entitled to attend the Annual Meeting.

MEETING AGENDA AND VOTING RECOMMENDATIONS

| Page Reference for More Information | Board Vote Recommendation | |

| Election of 9 directors | 4 and 36 | For each director nominee |

| Management proposal: | ||

| Ratify Deloitte & Touche LLP as our independent auditors for 2015 | 36 | For |

| Stockholder advisory vote: | ||

| Approve our named executive officers’ compensation | 37 | For |

| Transact other business that properly comes before the meeting |

BOARD NOMINEES

| Name | Director Since | Position with Our Company | Independent | Committee Membership | Other Public Company Boards | ||||

| Age | AC | CC | CGN | CDC | |||||

| Mark B. Slaughter | 56 | 2010 | Chief Executive Officer, President & Director | ||||||

| James H. Browning | 65 | 2010 | Chairman, Independent Director | X | C/F | X | • Texas Capital Bancshares • Endeavor International | ||

| Mattia Caprioli | 41 | 2013 | Independent Director | X | X | • Alliance Boots • Avincis | |||

| Charles L. Davis | 49 | 2005 | Independent Director | X | X | X | |||

| Ditlef de Vibe | 60 | 2011 | Independent Director | X | X | X | |||

| Kevin Mulloy | 56 | 2012 | Independent Director | X | X | C | |||

| Kevin J. O’Hara | 54 | 2010 | Independent Director | X | X | C | |||

| Keith Olsen | 58 | 2010 | Independent Director | X | C | X | |||

| Brent K. Whittington | 44 | 2010 | Independent Director | X | F | X | |||

| 2014 Meetings | 6 | 6 | 5 | 5 | |||||

| AC | Audit Committee | C | Chair |

| CC | Compensation Committee | F | Financial Expert |

| CGN | Corporate Governance and Nominating Committee | ||

| CDC | Corporate Development Committee |

| ii |

| Attendance: In 2014, each of our current directors attended at least 75% of the meetings of the Board and committees on which the member served during the year. | Director Elections: Each director is elected annually by a majority of votes cast. |

2014 PERFORMANCE AND COMPENSATION HIGHLIGHTS

RigNet performance. The Compensation Committee believes the Chief Executive Officer (“CEO”) and other named executives have performed well in a challenging market environment while executing on the Company’s growth plans that delivered record operating results in an above-target achievement against performance goals set for 2014 under the Management Incentive Plan (“MIP”), and that their compensation is commensurate with this performance.

Compensation decisions reflect a balanced and responsible pay approach. The Compensation Committee has responsibility for oversight of RigNet’s executive compensation framework and, within that framework and working with senior management, aligning pay with performance and creating incentives that reward responsible risk-taking, while also considering RigNet’s business environment.

The Compensation Committee targets executive base compensation to be between the 25th percentile and the median for our peer group. Our pay for performance philosophy is incorporated into our MIP, which compensates our executives with cash bonuses for meeting and exceeding corporate goals and objectives. Management’s performance during 2014 led to an overall 112% achievement for the performance goals under the MIP.

During 2014, in light of Mr. Slaughter’s performance and leadership, his base salary was increased 11% from the preceding year and was granted stock and option awards of 4,755 and 21,072 shares, respectively, which vest over four years. Based on Company and individual performance in 2014, Mr. Slaughter earned a cash bonus of $511,280. In response to current market conditions in the oil and gas industry, Mr. Slaughter’s base salary and target bonus percentage was not changed for 2015. The Compensation Committee believes that its decisions on Mr. Slaughter’s pay reflect his strong leadership, proven ability to grow the Company and his increased responsibilities resulting from organic growth and the integration of acquired businesses across the Company. The Compensation Committee believes its decisions on Mr. Slaughter’s pay to be consistent with prior years and represents a balanced and responsible pay-for-performance approach to compensation. Based on available peer compensation data, Mr. Slaughter’s total 2014 compensation is ranked at approximately 75%.

Compensation decisions for Messrs. Jimmerson, Sutton and Maytorena reflect their contributions to the Company’s overall performance and that of their respective business functions. Mr. Crenshaw’s employment with the Company ended effective February 18, 2015. Total compensation for these named executives also reflects a balanced and responsible pay-for-performance approach to compensation.

Equity compensation.Through equity compensation, our executives have a significant portion of compensation “at risk” and accordingly have a potential for earning above the median of our peer group. “At risk” means executives will realize increased value as they manage and operate the Company to achieve financial, operational and strategic goals, which we believe closely correlate to long-term stockholder value creation. RigNet grants restricted stock and option awards to named executives annually, which vest over 4 years through continued employment. Pursuant to the Securities and Exchange Commission (“SEC”) rules, equity awards are reported in full for 2014 in the respective columns in the Summary Compensation Table.

2014 Summary Compensation and Realized Compensation

| Salary | Bonus | Stock Awards | Option Awards | Non-Equity Incentive Plan | All Other Comp. | Total | |||||||||||||

| Mark Slaughter | $ 404,723 | $ 46,480 | $ 244,359 | $ 542,393 | $ 464,800 | $ 360 | $ 1,703,115 | |||||||||||||

| Chief Executive Officer and President | ||||||||||||||||||||

| Martin Jimmerson | 287,125 | - | 129,349 | 287,078 | 226,262 | 360 | 930,174 | |||||||||||||

Senior Vice President and Chief Financial Officer | ||||||||||||||||||||

| William Sutton | 259,000 | - | 114,343 | 253,874 | 190,736 | 360 | 818,313 | |||||||||||||

| Senior Vice President, General Counsel and Corporate Secretary | ||||||||||||||||||||

| Hector Maytorena | 235,250 | 25,578 | 67,321 | 149,421 | 170,520 | 360 | 648,450 | |||||||||||||

Group Vice President, Managed Services | ||||||||||||||||||||

| James Crenshaw | 222,500 | - | 65,317 | 145,071 | 155,905 | 360 | 589,153 | |||||||||||||

| Former Group Vice President, Western Hemisphere | ||||||||||||||||||||

| iii |

For more information on total compensation as calculated under SEC rules, see the narrative and notes accompanying the 2014 Summary Compensation Table, on page 23.

EXECUTIVE COMPENSATION PROGRAM HIGHLIGHTS

Key Features

| • | Clawback of incentive compensation and equity compensation, in the event of a financial restatement | • | Significant executive share ownership requirements and restrictions, including an anti-hedging policy | |

| • | No excise tax gross-ups |

Elements

| Type | Form | Terms | ||

| Equity | Stock Options | • Options generally vest 25% per year while employed | ||

• No automatic accelerated option vesting upon a change of control | ||||

| Restricted Stock | • Stock awards generally vest 25% per year while employed | |||

| • No automatic accelerated stock award vesting upon a change of control | ||||

| Cash | Salary |

| ||

| MIP Bonus | • Based on achievement of quantitative and qualitative goals - Funding level based on revenue and Adjusted EBITDA results - Awards based on achievement of specific goals | |||

| Long-term Performance Awards | • Based on achievement of quantitative performance goals over a multiple-year performance period | |||

| Retirement | 401K Match | • 4% match of voluntary contribution vests immediately | ||

| Other | Perquisites | • Life insurance |

GOVERNANCE HIGHLIGHTS

Board Leadership While our CEO serves as a Director on our Board, we have an independent director who is elected by the independent directors to serve as the chairman of the Board, with broad authority and responsibility over Board governance and its operations. See “Board Leadership Structure and Role in Risk Oversight” on page 8 for more information. Director Independence Eight out of nine of our director nominees are independent. An independent director chairs each Board committee. We believe our Board should consist primarily of independent directors. See “Director Independence” on page 9 for more information. | Board Risk Oversight Our Board has oversight for risk management with a focus on the most significant risks facing the Company, including strategic, operational, financial, legal and compliance risks. See “Board Leadership Structure and Role in Risk Oversight” on page 8 for more information. Corporate Development Our Board’s diversity of experience, technical and industry knowledge brings value by providing management oversight and guidance related to evaluating corporate development opportunities and managing risks from merger and acquisition initiatives. See “Corporate Development Committee” on page 12 for more information. |

| iv |

CONTENTS

NOTICE OF THE 2015 ANNUAL MEETING OF STOCKHOLDERS

RIGNET, INC.

1880 S. Dairy Ashford, Suite 300

Houston, Texas 77077-4760

PROXY STATEMENT

2014We are furnishing this proxy statement to stockholders in connection with RigNet’s solicitation of proxies on behalf of the Board of Directors for the 2015 Annual Meeting of StockholdersStockholders. Distribution of this proxy statement and proxy card to stockholders is scheduled to begin on or about April 1, 2015.

INFORMATION ABOUT THE MEETING, VOTING AND PROXIES

Date, Time and Place of Meeting

Our Board of Directors is asking for your proxy for use at the RigNet, Inc. 20142015 Annual Meeting of Stockholders (the “Annual Meeting”) or at any adjournments or postponements thereof. The Annual Meeting will be held on Friday, May 9, 2014,8, 2015, at 10:00 a.m., Central Daylight Time, at RigNet’s corporate office atRAC Conference Center – Washington Room, 1880 S. Dairy Ashford, Ashford Crossing II, Suite 300,220, Houston, Texas 77077. We have first released this proxy statement to our stockholders beginning on or about April 1, 2014.

Proposals

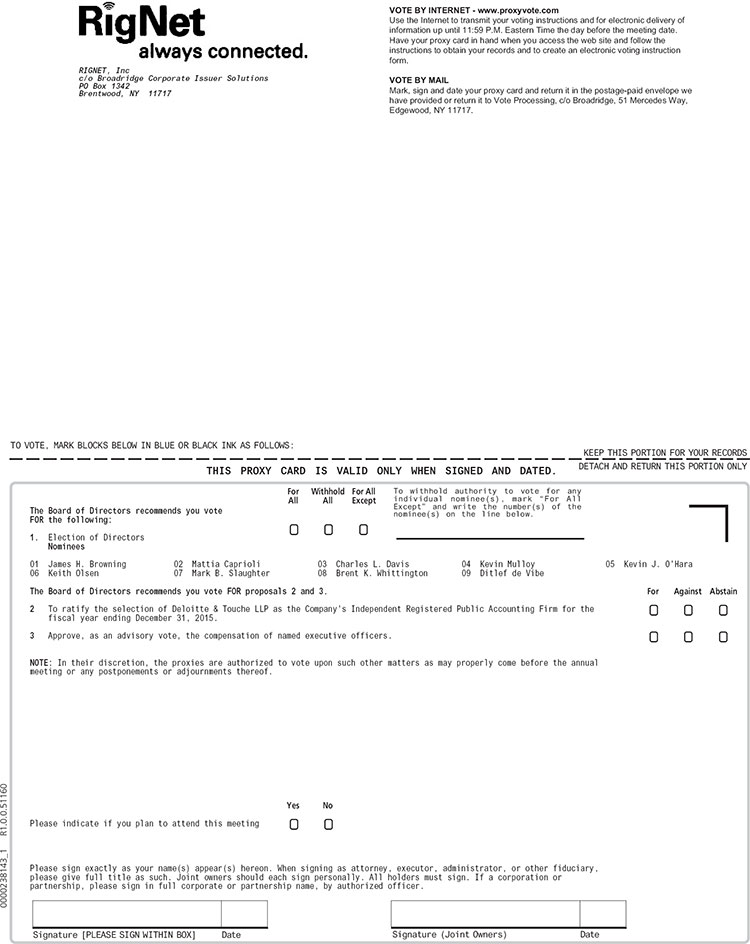

At our 20142015 Annual Meeting of Stockholders, we are asking our stockholders to consider and act upon proposals to: (1) elect nine directorsninedirectors to serve until our 20152016 Annual Meeting; (2) ratify the appointment of Deloitte & Touche LLP as our independent auditor for the fiscal year ending December 31, 2014;2015; and (3) approve, as ana non-binding advisory vote, the compensation of our named executive officers.

Record Date, Outstanding Shares and Quorum

Only stockholders of record at the close of business on March 21, 201420, 2015 (the “Record Date”) are entitled to notice of, and to vote at the Annual Meeting. As of the Record Date, there were 17,357,43917,654,918 outstanding shares entitled to vote at the Annual Meeting. The presence, in person or by proxy, of the holders as of the Record Date of a majority of our outstanding shares is necessary to constitute a quorum for purposes of voting on the proposals at the Annual Meeting. Withheld votes will count as present for purposes of establishing a quorum on the proposals.

If by the date of the Annual Meeting we do not receive sufficient shares to constitute a quorum or approve one or more of the proposals, the Chair of the Annual Meeting, or the persons named as proxies, may propose one or more adjournments of the Annual Meeting to permit further solicitation of proxies. The persons named as proxies would typically exercise their authority to vote in favor of adjournment.

Voting

If you are a holder of our common stock, you are entitled to one vote at the Annual Meeting for each share that you held as of the Record Date. Cumulative voting for directors is not permitted. The Inspector of Elections appointed for the Annual Meeting will tabulate all votes.

You may vote in person at the Annual Meeting or by proxy. Even if you plan to attend the Annual Meeting, we encourage you to vote your proxy card in advance of the Annual Meeting. If you plan to attend the Annual Meeting and wish to vote in person, we will give you a ballot at the meeting. However, please note that if your shares are held in “street name” (in the name of a broker or by a bank or other nominee), you are considered the beneficial owner of these shares and proxy materials are being forwarded to you by your broker or nominee, which is considered, with respect to these shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker how to vote; however, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain from your brokerage firm an account statement, letter or other evidence satisfactory to us of your beneficial ownership of the shares. Please vote your proxy by mail as soon as possible so that your shares may be represented at the Annual Meeting.

You may also attend the Annual Meeting via the Internet and vote during the Annual Meeting. To vote during the Annual Meeting via the Internet, you will need to follow the instructions on your proxy card and have the information available on your proxy card in order to access the Annual Meeting online.

Revoking Your Proxy

If you submit your proxy by mail, you may still revoke it at any time before voting takes place at the Annual Meeting. If you are the record holder of your shares and wish to revoke your proxy, you may revoke it as follows: (i) by delivering, before or at the Annual Meeting, a new proxy with a later date; (ii) by delivering, on or before the business day prior to the Annual Meeting, a notice of revocation to our Corporate Secretary at the address set forth in the notice of the Annual Meeting; (iii) by attending the Annual Meeting and voting, although your attendance at the Annual Meeting, without actually voting, will not by itself

revoke a previously granted proxy; or (iv) if you have instructed a broker to vote your shares, you must follow the directions received from your broker to change those instructions.

If you sign and return your proxy card but do not give any voting instructions, your shares will be voted in favor of the election of each of the director nominees listed in Proposal 1One and in favor of Proposals 2Two and 3.Three. As far as we know, no other matters will be presented at the Annual Meeting. However, if any other matters of business are properly presented, the proxy holders named on the proxy card are authorized to vote the shares represented by proxies according to their judgment.

Soliciting Proxies

RigNet will pay all expenses of soliciting proxies to be voted at the Annual Meeting. After the proxies are initially distributed, RigNet and its officers, directors and employees (who will not receive any additional compensation for any solicitation of proxies) may also solicit proxies by mail, electronic mail, telephone or in person. We will ask brokers, custodians, nominees and other record holders to forward copies of the proxy materials to beneficial owners for whom they hold shares.

Annual Report on Form 10-K and Additional Materials

The Notice of Annual Meeting, this Proxy Statementproxy statement and our Annual Report on Form 10-K for the year ended December 31, 20132014 have been made available to all stockholders entitled to vote at the Annual Meeting. These materials may also be viewed at “https://materials.proxyvote.com/766582”.

Unless the context requires otherwise, the terms “RigNet,” the “Company,” “our,” “we,” “us” and similar terms refer to RigNet, Inc., together with its consolidated subsidiaries.

OUR BOARD OF DIRECTORS AND NOMINEESGOVERNANCE

Our Board of Directors currently consists of tennine directors, each of whom has a term that expires at the Annual Meeting. Each of our current Board members has been nominated to stand for re-election at the Annual Meeting, except for Kevin Neveu, who will not be standing for re-election as a member of our Board. Upon the expiration of Mr. Neveu’s term as a director at the Annual Meeting, the number of directors that will constitute our Board will be decreased from ten to nine.Meeting. Each director elected at the Annual Meeting to our Board of Directors will serve in such capacity until his or her term expires at our next annual meetingAnnual Meeting or his or her successor has been duly elected and qualified, subject to their earlier death, resignation or removal. All directors, other than our Chief Executive Officer (“CEO”),CEO, Mark Slaughter, wereare “independent directors” and metmeet the independence requirements under the listing standards of the NASDAQ. There are no family relationships among any of our directors or executive officers.

At the Annual Meeting, our stockholders will consider and act upon a proposal to elect nine directors to our Board of Directors to serve until the 20152016 Annual Meeting of Stockholders. Each of the nominees has consented to serve as a director if so elected. The persons named as proxies in the accompanying proxy card, who have been designated by our Board of Directors, intend to voteFOR the election of the director nominees unless otherwise instructed by a stockholder in a proxy card. If these nominees become unable for any reason to stand for election as a director, the persons named as proxies in the accompanying proxy card will vote for the election of such other person or persons as our Board of Directors may recommend and propose to replace such nominee or nominees.

Director NomineesDIRECTOR NOMINEES

Information concerning the nine director nominees is set forth below.

Name | Age | Position with Our Company | Director Since | Age | Position with Our Company | Director Since | ||||||

Mark B. Slaughter | 55 | Chief Executive Officer, President and Director | 2010 | 56 | Chief Executive Officer, President and Director | 2010 | ||||||

James H. Browning | 64 | Chairman, Independent Director | 2010 | 65 | Chairman, Independent Director | 2010 | ||||||

Mattia Caprioli | 40 | Independent Director | October 31, 2013 | 41 | Independent Director | 2013 | ||||||

Charles L. Davis | 48 | Independent Director | 2005 | 49 | Independent Director | 2005 | ||||||

Ditlef de Vibe | 59 | Independent Director | 2011 | 60 | Independent Director | 2011 | ||||||

Kevin Mulloy | 55 | Independent Director | 2012 | 56 | Independent Director | 2012 | ||||||

Kevin J. O’Hara | 53 | Independent Director | 2010 | 54 | Independent Director | 2010 | ||||||

Keith Olsen | 57 | Independent Director | 2010 | 58 | Independent Director | 2010 | ||||||

Brent K. Whittington | 43 | Independent Director | 2010 | 44 | Independent Director | 2010 | ||||||

| ||||

| Mark B. Slaughter | ||||

| DIRECTOR QUALIFICATIONS | ||||

| • | Industry Knowledge and Experience – | |||

| - | Current Chief Executive Officer and President of RigNet | |||

| - | Former President of broadband division for Stratos Global Corporation | |||

| • | Leadership and Global Experience – CEO and president positions for over 10 years | |||

Mr. Slaughter has served as the CEO and President since August 2007 and a Director since the completion of our initial public offering (“IPO”) in December 2010. Prior to that, Mr. Slaughter served as our President and Chief Operating Officer from January 2007 to July 2007. Prior to joining us, Mr. Slaughter served as Vice President and General Manager for Security Services Americas, a division of United Technologies Corporation from July 2005 to December 2006 and as President, Broadband Division for Stratos Global Corporation, which was later acquired by Inmarsat plc, from January 2003 to December 2004. Mr. Slaughter is a graduate of United Technologies’ Executive Program at the University of Virginia’s Darden Graduate School of Business and has attended Stanford Law School’s Directors’ College. He received an A.B. in General Studies, C.L.G.S., concentration in Economics, from Harvard College and an MBA from Stanford’s Graduate School of Business. Mr. Slaughter brings an intimate knowledge of our business and our industry to our Board.

| ||||

| James H. Browning | ||||

| DIRECTOR QUALIFICATIONS | ||||

| • | Finance Experience –retired KPMG LLP partner, served as KPMG’s Southwest Area Professional Practice Partner and SEC Reviewing Partner | |||

| • | Leadership and Board Experience – serves on public company boards of Texas Capital Bancshares, Inc. and Endeavour International Corporation | |||

James H.

Mr. Browninghas served on our Board since December 2010, and as a Directorthe Chairman of our Board since May 16, 2012, Co-Chairman of our Board from March 7, 2012 to May 16, 2012 and Chairman of our Audit Committee since December 2010 when we completed our IPO. From March 7, 2012 to May 16, 2012, Mr. Browning served as Co-Chairman of our Board. Mr. Browning continued to serve as the Chairman of our Board since May 16, 2012. Mr. Browning served as a partner at KPMG LLP, an international accounting firm, from July 1980 until his retirement in September 2009. Mr. Browning began his career at KPMG LLP in 1971, becoming a partner in 1980. Mr. Browning most recently served as KPMG’s Southwest Area Professional Practice Partner in Houston. Mr. Browning has also served as an SEC Reviewing Partner and as Partner in Charge of KPMG LLP’s New Orleans audit practice. Mr. Browning received a B.S. degree in Business Administration from Louisiana State University and is a Certified Public Accountant. He currently serves on the boards of Texas Capital Bancshares, Inc., a publicly traded financial holding company and Endeavour International Corporation, a publicly traded international oil and gas exploration and production company. Mr. Browning brings a wealth of knowledge dealing with financial and accounting matters to our Board as well as extensive knowledge of the role of public company boards of directors.

| Mattia Caprioli | |||

| DIRECTOR QUALIFICATIONS | ||||

| • | Global Experience – | |||

| - | Leads KKR’s Business Services industry team in Europe | |||

| - | Mergers, acquisitions and financing experience with Goldman Sachs in London | |||

| • | Leadership and Board Experience – serves on the Board of Alliance Boots and Avincis | |||

Mattia Caprioli has served on our Board since October 31, 2013. Mr. Caprioli is a Member of Kohlberg Kravis Roberts & Co. L.P. (“KKR”) responsible for its Business Services industry team in Europe. Mr. Caprioli has held leadership roles in many KKR investments including Legrand, Toys ‘R’ Us, Alliance Boots, Inaer and Bond (now Avincis) since 2001. He also currently serves on the BoardBoards of Alliance Boots and Avincis. Prior to joining KKR, Mr. Caprioli was with Goldman Sachs International in London, where he was involved in a broad array of mergers, acquisitions and financings across a variety of industries. He holds a Master of Science degree from L. Bocconi University, Milan, Italy. Mr. Caprioli brings a diverse international background with extensive business services expertise to the Board.

| ||||

| Charles L. Davis | ||||

| DIRECTOR QUALIFICATIONS | ||||

| • | Industry Knowledge and Experience – Partner in Houston Ventures, an investment firm funding companies that apply technology solutions in the energy industry | |||

| • | Finance Experience – experience in finance, accounting and investment banking | |||

Charles L. Davis has served as a member of our Board of Directors since June 2005. Mr. Davis has been a partner in Houston Ventures, formerly known as SMH Private Equity Group, a United States-based investment firm that funds companies that apply technology solutions in the energy sector, since December 2004. Mr. Davis received a Bachelor’s degree in Business from Washington and Lee University and is a Certified Public Accountant in the Commonwealth of Virginia. Mr. Davis brings experience in finance, accounting and investment banking to our Board as well as a wealth of experience in the energy industry.

| ||||

| Ditlef de Vibe | ||||

| DIRECTOR QUALIFICATIONS | ||||

| • | Leadership and Global Experience – Managing Partner of Kistefos Venture Capital, a venture capital firm investing in the IT and telecommunications industries | |||

| • | Technology Knowledge and Experience – - Former CEO of Global IP Solutions - Various Director roles with IBM | |||

Ditlef de Vibe has served on our Board since May 2011. From 2001 to 2011, Mr. de Vibe served as managing partner of Kistefos Venture Capital, a venture capital firm that primarily invests in the IT and telecommunications industries. Since leaving Kistefos Venture Capital, Mr. de Vibe’s principal occupation is as an independent investor and board member for several private Norwegian companies. From 2007 to 2008, Mr. de Vibe also served as Chief Executive Officer of Global IP Solutions (GIPS) Holdings AB, a company that was publicly traded in Norway until its sale to Google, Inc. From 1996 to 2001, Mr. de Vibe served in various capacities with IBM, including IBM’s Director of Network Outsourcing EMEAOutsourcingEMEA from 1999 to 2001, Director of Network Service Sales EMEA from 1998 to 1999, and Director of Network Outsourcing Services EMEA from 1996 to 1998. He holds a Master of Science degree from the University of Oslo. Mr. de Vibe brings a wealth of experience in IT and telecommunications along with extensive operational and commercial competencies.

| ||||

| Kevin Mulloy | ||||

| DIRECTOR QUALIFICATIONS | ||||

| • | Leadership and Global Experience – | |||

| - | Former President of Presidio Managed Networks | |||

| - | Former President of Intelsat Global Service Corporation | |||

| • | Technology Experience – served as Executive Vice President of Corporate Development at an advanced information technology professional and managed service company | |||

Kevin Mulloy has served as a Director since March 2012. Mr. Mulloy has served as Executive Vice President of Corporate Development at Presidio, Inc., an advanced information technology professional and managed service company, from July 2011 to May 2013. Prior to that, Mr. Mulloy served as President of Presidio Managed Networks, the managed services business at Presidio, from June 2008 to July 2011, and from September 2007 to June 2008 he served as the Executive Vice President of Operational Strategy for Presidio. For the five years prior to joining Presidio, Mr. Mulloy held leadership roles with Intelsat S.A., a provider of satellite services worldwide, including President of Intelsat Global Service Corporation from January 2003 to February 2006 and Senior Vice President of Strategy, Business Development and M&A from January 2001 to January 2003. Mr. Mulloy’s experience also includes ten years with McKinsey & Company, a management consulting firm; three years with Gould Inc., an aerospace and defense company; and more than five years in the United States Navy, serving in the Surface Nuclear Propulsion branch of the Navy. Mr. Mulloy has a BSME from the US Naval Academy and an MBA from Wharton, University of Pennsylvania. Mr. Mulloy brings extensive operational satellite, telecommunications and information technology infrastructure experience to the Board.

| ||||

| Kevin J. O’Hara | ||||

| DIRECTOR QUALIFICATIONS | ||||

| • | Industry Knowledge and Technology Experience – | |||

| - | President, Chief Executive Officer and Director of a communications provider | |||

| - | Co-founder of Level 3 Communications, Inc., a provider of IP-based communications | |||

| • | Leadership and Board Experience – | |||

| - | CEO and Director of Integra | |||

| - | CEO and president positions for over 20 years | |||

Kevin J. O’Harahas served as a Director since December 2010 when we completed our IPO. Mr. O’Hara currently servesmost recently served as President, Chief Executive Officer and director of Integra, a communications provider. He served on its Board since December 2009, was appointed chairman of the board in March 2011 and was named CEO in December 2011. Mr. O’Hara left Integra in September 2014. Prior to joining Integra, he was a co-founder and Chairman of the Board of Troppus Software Corporation, an early stage software company providing technical solutions to service providers that support home technology and networks, from March 2009 until it was acquired by a major service provider in January 2011. Since January 2011, Mr. O’Hara has also served on the Board of Directors of Elemental Technologies, Inc. and, in August 2011, he was named Chairman.Chairman of Elemental Technologies, Inc., a leading provider of video processing solutions for broadcast and on-line video customers. Prior to that, Mr. O’Hara was a co-founder of Level 3 Communications, Inc., a provider of IP-based communications services to enterprise, content, government and wholesale customers, and served as its President from July 2000 to March 2008 and as the Chief Operating Officer of Level 3 Communications, Inc. from March 1998 to March 2008. From August 1997 to July 2000, Mr. O’Hara served as Executive Vice President of Level 3 Communications, Inc. Prior to that, Mr. O’Hara served as President and Chief Executive Officer of MFS Global Network Services, Inc. from 1995 to 1997, and as Senior Vice President of MFS and President of MFS Development, Inc. from October 1992 to August 1995. From 1990 to 1992, he was a Vice President of MFS Telecom, Inc. Mr. O’Hara has a Master of Business Administration from the University of Chicago and a Bachelor of Science in Electrical Engineering from Drexel University. Mr. O’Hara brings a wealth of experience in the communications industry to our Board as well as experience running a public company.

| Keith Olsen | |||

| DIRECTOR QUALIFICATIONS | ||||

| • | Industry Knowledge and Technology Experience – | |||

| - | CEO and Director of a data center services company | |||

| - | Former CEO, President and Director of a provider of network-neutral data center | |||

| • | Leadership and Global Experience – | |||

| - | International business development with international carriers and service providers | |||

| - | Public Company CEO | |||

Mr. Olsenhas served as a Director since December 2010 when we completed our IPO. Mr. Olsen currently serves as Chief Executive Officer of vXchnge Holdings LLC, a private company offering data center services. Mr. Olsen served as Chief Executive Officer, President and Director of Switch and Data Facilities Company, Inc., a provider oflisted NASDAQ company, which provided network-neutral data centers that house, power and interconnect the Internet, from February 2004 to May 2010, when Switch and Data Facilities Company, Inc. was acquired by Equinix, Inc. Prior to that, Mr. Olsen served as a Vice President of AT&T, where he was responsible for indirect sales and global sales channel management from May 1993 to February 2004. From 1986 to 1993, Mr. Olsen served as Vice President of Graphnet, Inc., a provider of integrated data messaging technology and services. Mr. Olsen has a Bachelor’s degree from the State University of New York, Geneseo. Mr. Olsen brings experience in running a public company to our Board as well as a wealth of experience in the communications industry.

| Brent K. Whittington | |||

| DIRECTOR QUALIFICATIONS | ||||

| • | Finance Experience— | |||

| - | Former CFO of Windstream Corporation and its predecessor, Alltel Holding Corp | |||

| - | Arthur Andersen LLP experience for over eight years | |||

| • | Leadership and Industry Experience – former COO of a communications company providing phone, high-speed Internet and high-definition digital TV services | |||

Mr. Whittingtonhas served as a Director since December 2010 when we completed our IPO. Mr. Whittington has served as the Chief Operating Officer of Windstream Corporation, a publicly-tradedpublicly traded communications company providing phone, high-speed Internet and high-definition digital TV services, sincefrom August 2009.2009 to September 2014. Prior to that, Mr. Whittington served as the Executive Vice President and Chief Financial Officer of Windstream Corporation from July 2006 to August 2009. From December 2005 to July 2006, Mr. Whittington

served as Executive Vice President and Chief Financial Officer of Windstream

Corporation’s predecessor, Alltel Holding Corp. From 2002 to August 2005, Mr. Whittington served as Vice President of Finance and Accounting of Alltel Corporation, parent company of Alltel Holding Corp and, from August 2005 to December 2005, Mr. Whittington also served as the Senior Vice President-Operations Support of Alltel Corporation. Prior to joining Alltel, Mr. Whittington was with Arthur Andersen LLP for over eight years. Mr. Whittington has a degree in accounting from the University of Arkansas at Little Rock. Mr. Whittington brings experience in finance and accounting to our Board as well as a wealth of experience in the communications industry.

The following table provides information regarding our executive officers.

|

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

|

Mark Slaughter has served as our Chief Executive Officer and President since August 2007. See his biographical summary presented earlier in this proxy statement under the heading “Our Board of Directors and Nominees – Director Nominees.”

Martin Jimmerson has served as our Senior Vice President and Chief Financial Officer since February 2014 and our Chief Financial Officer from November 2006 through January 2014. Prior to that, Mr. Jimmerson served as Chief Financial Officer for River Oaks Imaging & Diagnostic, LP from November 2002 to December 2005. Mr. Jimmerson received a B.A. degree in accounting from Baylor University.

William Sutton has served as our Senior Vice President, General Counsel and Corporate Secretary since February 2014. Prior to that, Mr. Sutton served as our Vice President, General Counsel and Corporate Secretary from May 2009 through January 2014 and Vice President and General Counsel from March 2008 through May 2009. Mr. Sutton served as Chairman for Sweeten & Sutton Brokerage, Inc. from March 2007 to February 2008 and President and Chief Executive Officer for Abbey SA, LP from April 2004 to October 2006. He has attended Stanford Law School’s Directors’ College. Mr. Sutton received a Bachelor of Business Administration degree from the University of Texas at Austin and a Juris Doctorate from the University of Houston.

Hector Maytorena has served as our Group Vice President, Eastern Hemisphere since February 2014. Prior to that, Mr. Maytorena served as our Vice President & General Manager, Eastern Hemisphere from April 2012 through January 2014, our Vice President & General Manager, Western Hemisphere from November 2009 through March 2012, and as Vice President, Global Sales & Marketing from November 2007 through October 2009. Prior to joining RigNet, he served as General Manager of Southeast Texas for United Technologies’ UTC Fire & Security (operating under the Chubb Security and Redhawk brands) from November 2006 to November 2007 and Director of Sales at Chubb Security USA from August 2005 to November 2006. Prior to that role, Mr. Maytorena served in various leadership roles at Stratos Global Corporation’s Broadband Division with his last assignment as Director of Global Sales and Marketing from November 2002 to August 2005. Mr. Maytorena is a graduate of United Technologies’ Emerging Leaders Program at the University of Virginia’s Darden Graduate School of Business and has completed an executive education course in Emerging Growth Companies at Stanford University’s Graduate School of Business.

James Crenshaw has served as our Group Vice President, Western Hemisphere since February 2014 and Vice President & General Manager, Western Hemisphere from January 18, 2013 through January 2014. Prior to joining RigNet, Mr. Crenshaw served as regional engineering manager, North America for Weatherford Secure Drilling Services from December 2011 to January 2013. Mr. Crenshaw served as North American Product Line Manager for Managed Pressure Drilling with Weatherford from August 2009 to December 2011 and Regional Manager for the Americas with the Secure Drilling–Weatherford JV from November 2008 to August 2009. Prior to that, Mr. Crenshaw was the Senior Vice President for Latin America with Expro America– Powerwell Services from May

2005 to November 2008. He has also attended the Executive MBA short course program at the Thunderbird School of Global Management and has completed an executive education course in Emerging Growth Companies at Stanford University’s Graduate School of Business. Mr. Crenshaw earned his Bachelor of Science degree in Petroleum Engineering from Texas A&M University.

Morten Hagland Hansen has served as our Senior Vice President, Business Services and Chief Technology Officer since February 2014. Prior to that, Mr. Hansen served as our Vice President, Business Services from February 2013 through January 2014, Vice President, Global Engineering and Operations from July 2011 through January 2013, Vice President, Global Engineering from February 2009 to July 2011, and Director of Global Engineering from January 2007 to February 2009. From October 2001 to January 2007, Mr. Hansen served as our Engineering Manager. Prior to joining RigNet in 2001, he had experience in information technology and telecoms engineering, design and deployment. Mr. Hansen recently completed an executive education course in Customer-Focused Innovation at Stanford University’s Graduate School of Business.

The Board and the Company annually review RigNet’s governance documents, which are available on our website. These governance materials include our Code of Ethics, Policy Governing Director Qualifications and Nominations and Director Independence, and Board committee charters. The Board regularly reviews corporate governance developments and, when appropriate, modifies its governance policies, committee charters and key practices.

Code of Ethics

We have adopted a code of business conduct and ethics applicable to our principal executive, financial and accounting officers and all persons performing similar functions. A copy of that code is available on our corporate website at “http://investor.rig.net/governance.cfm”.

Composition of the Board of Directors

Our Board of Directors currently consists of tennine members, nineeight of whom are non-employee members. Mr. Slaughter, who serves as the CEO and President, also serves as a director. Each director holds office until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. Our by-laws permit our Board of Directors to establish by resolution the authorized number of directors. Upon the expiration of Mr. Neveu’s term as a director at the Annual Meeting, the number of directors that will constitute our Board will be decreased from ten to nine.

With respect to the Annual Meeting, we have nine nominees and nine available board seats. A board member may be removed outside of the normal election process for cause by the affirmative vote of the holders of a majority of the shares then entitled to vote at an election of our directors. Each properly executed proxy received in time for the Annual Meeting will be voted as specified therein. The nine nominees receiving the most votes cast at the Annual Meeting will be elected to our Board of Directors.

Board Leadership Structure and Role in Risk OversightBOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

Currently, we separate the role of Chairman and Chief Executive Officer. In addition, each of the committees of our Board committee is presently chaired by ancomprised solely of independent director.directors. The Chief Executive Officer is responsible for setting the strategic direction for the companyCompany and the day to dayday-to-day leadership and performance of the company,Company, while the Chairman of the Board provides guidance to the Chief Executive Officer, approves the agenda for Board meetings, and presides over meetings of the full Board. The independent members of the Board also regularly meet in executive session without management present. The Board believes this separation is appropriate at this time because of our public status. Our Board does not have a policy on whether or not the roles of Chairman of the Board and Chief Executive Officer should be separate and, if they are to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee or former employee. The Board believes that it should be free to make a choice from time to time in any manner that it believes is in the best interests of our Company and our stockholders at that time.

The Board actively oversees management, particularly through regular conferences between the Chief Executive Officer and the Chairman. The Board reviews the Chairman of the Board position annually after the annual meetingAnnual Meeting of stockholders.Stockholders.

Risk Oversight

Risk is an inherent part of RigNet’s business activities and is critical to the Company’s growth and success. The Board seeks to assess major risks facing our Company and options for their mitigation in order to promote our stockholders’ and other stakeholders’ long-term interests. We reward our executives for taking responsible risks in line with the Company’s strategic objectives and overall risk appetite. Depending on the nature of the risk involved and the particular business function involved, we use a wide variety of risk mitigation strategies, including delegation of authorities, standardized processes, strategic planning, operating reviews and insurance.

The Board overseeshas oversight for risk management and actively reviews risk management practices through continuous dialogues and receipt of management reports. The Board and its committees collectively oversee risk by actively reviewing material management decisions throughout the year in this area and through the Corporate Governance and Nominating Committee, which actively monitors enterprise risk. areas that risk responsibility has been delegated.

The Board regularly reviews risk management practices in such areashas delegated responsibility for the oversight of specific risks to the Board committees as credit risk, liquidity risk, operational risk and compliance risk by obtaining detailed reports from management,

| Corporate Governance and Nominating | • | Confirms the existence and capability of risk management systems and controls specific to operational, technology, compliance, reputational and political risks |

| • | Reviews assessments and implementation of risk-based controls for our business activities | |

| • | Oversees risk related to the Company’s governance structure and processes, including risks arising from related person transactions | |

| Audit | • | Oversees policies and processes related to the financial statements, financial reporting process, compliance and auditing |

| • | Monitors ongoing compliance issues and matters and meets with our independent accounting firm | |

| • | Reviews risk management practices and performance related to credit risk, liquidity risk and compliance risks | |

| Compensation | • | Oversees the risk management associated with management resources, structure, succession planning and management development and selection processes |

| • | Evaluates the effect the compensation structure may have on risk decisions | |

| Corporate Development | • | Provides guidance related to corporate development opportunities |

| • | Reviews risk mitigation strategies in connection with merger and acquisition initiatives | |

continuous dialogues with management, and providing input on material corporate decisions in these areas. The Board, primarily through the Audit Committee, also reviews financial and accounting risks through regular meetings with our outside independent accounting firm. The Board, primarily through the Corporate Governance and Nominating Committee, also reviews the assessment and implementation of risk-based controls for our business activities which involve material risk to us and our stockholders. The Board, primarily through the Compensation Committee, also reviews risks associated with our compensation plans and arrangements.

The extent of the Board’s oversight function has the effect of solidifying the Board’s leadership structure by providing knowledge and input into material risk decisions.

Director IndependenceDIRECTOR INDEPENDENCE

Our Board of Directors has reviewed the independence of each director and considered whether any director had or has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Board of Directors has determined that Messrs. Browning, Caprioli, Davis, de Vibe, Mulloy, Neveu, O’Hara, Olsen, and Whittington qualify as “independent” in accordance with the published listing standards of the NASDAQ. Mr. Slaughter is not independent by virtue of his role as CEO and President of our Company.

In addition, the members of the Audit Committee of our Board of Directors each qualify as “independent” under standards established by the Securities and Exchange Commission (“SEC”)SEC and NASDAQ for members of audit committees, and the Audit Committee includes at least one member who is determined by our Board of Directors to meet the qualifications of an “audit committee financial expert” in accordance with SEC rules. Mr.Messrs. Browning and Mr. Whittington are independent directors who have been determined to be audit committee financial experts. Stockholders should understand that this designation is a disclosure requirement of the SEC related to Mr. Browning’sMessrs. Browning and Mr. Whittington’s experience and understanding with respect to certain accounting and auditing matters. The designation does not impose on them any duties, obligations or liability that are greater than are generally imposed on them as members of the Audit Committee and Board of Directors, and their designation as audit committee financial experts pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit Committee or Board of Directors.

In addition, the members of the Compensation Committee of our Board of Directors each qualify as “independent” under standards established by the SEC and NASDAQ for members of compensation committees.

Policy Governing Director Qualifications and NominationsPOLICY GOVERNING DIRECTOR QUALIFICATIONS AND NOMINATIONS

Our Company seeks directors who possess, at a minimum, the qualifications and skills described below as set forth in our Policy Governing Director Qualifications and Nominations. Our Company considers diversity in its nomination of directors, and in its assessment of the effectiveness of the Board and its committees. In considering diversity, we evaluate each director candidate in the context of the overall composition and needs of our Board, with the objective of recommending a group that can best manage the business and affairs of the Company and represent stockholder interests using its diversity of experience. Our Corporate Governance and Nominating Committee will consider these and other qualifications, skills and attributes when recommending candidates to our Board.

At a minimum, our Corporate Governance and Nominating Committee must be satisfied that each Committee-recommended nominee meets the following minimum qualifications:

| • | The candidate shall exhibit high standards of integrity, commitment and independence of thought and judgment. |

| • | The candidate shall be committed to representing the long-term interests of our Company’s stockholders. |

| • | The candidate shall have sufficient time and availability to devote to the affairs of our Company, particularly in light of the number of boards on which the nominee may serve. |

| • | To the extent the candidate serves or has previously served on other boards, the candidate shall have a demonstrated history of contributing at board meetings. |

| • | The candidate |

In addition to the minimum qualifications for each candidate set forth above, our Corporate Governance and Nominating Committee shall recommend that our Board select persons for nomination to help ensure that:

| • | A majority of the Board is “independent” in accordance with the standards, if any, promulgated by the SEC, |

| • | Each of our Audit, Compensation and Corporate Governance and Nominating Committees are comprised entirely of independent directors. |

| • | At least one member of our Audit Committee shall have such experience, education and other qualifications necessary to qualify as an “audit committee financial expert” as defined by the rules of the SEC. |

In addition, to any other standards our Corporate Governance and Nominating Committee may deem appropriate from time to time for the overall structure and composition of our Board, the Committee may considerseeks directors with the following factors when selecting and recommending that our Board select persons for nomination:types of experience

Leadership experience.We believe that directors who have held significant leadership positions, especially CEO positions, over an extended period, provide the Company with unique insights. These people generally possess extraordinary leadership qualities, and the ability to identify and develop those qualities in others. They demonstrate a practical understanding of organizations, processes, strategy and risk management, and know how to drive change and growth. Technology experience. As a technology-based communication company, we seek directors with backgrounds in technology and a deep understanding of technology risks because our success depends on reliability of our technology, investments in new technologies and access to new ideas. Global experience. RigNet’s continued success depends, in part, on its success in continuing to grow its businesses outside the United States. For example, in 2014, approximately 70% of RigNet’s revenues came from outside the United States. | Finance experience. We believe that an understanding of finance and financial reporting processes is important for our directors as RigNet measures its operating and strategic performance by reference to financial goals. In addition, accurate financial reporting and robust auditing are critical to RigNet’s success. We seek to have directors who qualify as audit committee financial experts, and we expect all of our directors to be financially knowledgeable. As part of this qualification, we also seek directors who have relevant risk management experience. Industry experience. We seek to have directors with experience as executives or directors or in other leadership positions in the |

Marketing experience. RigNet seeks to grow organically by identifying and |

important to us.

Communications to Our Board of DirectorsCOMMUNICATIONS TO OUR BOARD OF DIRECTORS

Our Board of Directors has a process in place for communicationcommunications with stockholders. Stockholders should initiate any communications with our Board in writing and send them to our Board of Directors, c/o William Sutton, Senior Vice President, General Counsel and Corporate Secretary, RigNet, Inc., 1880 S. Dairy Ashford, Suite 300, Houston, Texas 77077-4760. All such communications will be forwarded to the appropriate directors. This centralized process will assist our Board of Directors in reviewing and responding to stockholder communications in an appropriate manner. If a stockholder wishes for a particular director or directors to receive any such communication;communications, the stockholder must specify the name or names of any specific Board recipient or recipients in the communication.communications. Communications to our Board of Directors must include the number of shares owned by the stockholder as well as the stockholder’s name, address, telephone number and emaile-mail address, if any.

Meetings of Our Board of Directors and Attendance at Annual MeetingsMEETINGS OF OUR BOARD OF DIRECTORS AND ATTENDANCE AT ANNUAL MEETINGS

During 2013,2014, our Board of Directors held 8 regular meetings, including our last annual meeting.six meetings. The standing Committees of our Board of Directors held an aggregate of 2522 meetings during this period. Each director attended at least 75.0%75% of the aggregate number of meetings of the Board and Committees on which they served, except Mr. Caprioli who joined the Board on October 31, 2013 and did not attend the December 2013 meeting of the Board.

served. Each member of our Board of Directors is expected to attend our annual meetings of stockholders. Each person who was a director at the time of our 2013 annual meeting2014 Annual Meeting of stockholdersStockholders attended such meeting.meeting, except Mr. Neveu, who did not stand for re-election.

Committees of Our Board of DirectorsCOMMITTEES OF OUR BOARD OF DIRECTORS

Our Board of Directors currently has standing Audit, Compensation, Corporate Governance and Nominating and Corporate Development Committees. Each member of the Audit, Compensation, and Corporate Governance and Nominating Committeeand Corporate Development Committees is an independent director in accordance with the NASDAQ listing standards described above and applicable SEC regulations. Our Board of Directors has adopted a written charter for each of these Committees, which sets forth each Committee’s purposes, responsibilities and authority. These committee charters are available on our website at “http://investor.rig.net/governance.cfm”.

| Audit Committee | |||

| • | Select and oversee the independent accounting firm | Number of Meetings in 2014: | |

| • | Oversee the quality and integrity of our financial reporting | 6 | |

| • | Review the organization and scope of our internal audit function and our disclosure and internal controls | Committee Members: | |

| • | Oversee the Company’s legal and regulatory compliance | Browning (C, F, I) Mulloy (I) Whittington (F, I) | |

| • | Approve audit and non-audit services provided by our independent auditors | ||

| • | Monitor financial reporting activities and the accounting standards and principles followed | ||

C Chair of the Committee

TheF Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities to the Company and our stockholders by overseeing the quality and integrity of our financial reporting; accounting policies and procedures; disclosure controls and procedures; compliance with legal and regulatory requirements; independent auditor qualifications, independence and performance; and the internal audit function. During 2013, the Audit Committee held 5 meetings. The Audit Committee is currently comprised of three directors: Messrs. Browning (Chairman), Mulloy and Whittington. Each member of the Audit Committee is “independent”Financial Expert as defined under SEC rules

I Satisfies standards established by the SEC and NASDAQ listing standards and applicable SEC rules, and is financially literate. Mr. Browning and Mr. Whittington have each beento be designated as an “audit committee financial expert”.independent director

The report of our Audit Committee appears under the heading “Report of the Audit Committee” below.

Compensation Committee

The Compensation Committee’s primary responsibilities are to: (i) review and recommend for Board approval the compensation arrangements for the CEO, (ii) review and recommend for Board approval compensation for our directors, (iii) make recommendations to the Board with respect to the non-CEO executive officers of our Company, (iv) to consider, recommend, administer and implement Board approved compensation plans, policies and programs including incentive-compensation and long-term incentive plans, and (v) reviewing succession planning for our executive officers. The Compensation Committee also oversees the preparation of a report on executive compensation for inclusion in the annual proxy statement.

| Compensation Committee | |||

| • | Review and recommend for Board approval the compensation of the CEO | Number of Meetings in 2014: | |

| • | Review and recommend for Board approval the compensation of the Board | 6 | |

| • | Make recommendations to the Board with respect to our non-CEO executive officers | Committee Members: | |

| • | Administer and implement Board approved compensation plans, policies, and programs, including short and long-term incentive plans | Olsen (C, I) de Vibe (I) O’Hara (I) | |

| • | Review succession planning for our executive officers | ||

During 2013, the Compensation Committee held 8 meetings. The Compensation Committee is currently comprised of four directors: Messrs. Olsen (Chairman), Davis, Neveu and O’Hara. Upon the expiration of Mr. Neveu’s term as a director at the Annual Meeting, he will cease to be a member of the Compensation Committee. Each of the Compensation Committee members is “independent” as defined by the current NASDAQ listing standards and applicable SEC rules. All Compensation Committee members are also “non-employee directors” as defined by Rule 16b-3 under the Securities Exchange Act of 1934, as amended (“Exchange Act”). The report of our Compensation Committee appears under the heading “Compensation Committee Report” below.

Procedures and Processes for Determining Compensation - Please refer to “Compensation Discussion and Analysis, The Compensation Committee,” below for a discussion of the Compensation Committee’s procedures and processes for making compensation determinations.

Compensation Committee Interlocks and Insider Participation -No member of the Compensation Committee has any relationship with our Company that is required to be disclosedrequiring disclosure in any of the reports that we file with the SEC, other than service on our Board of Directors. None of our named executive officers serves as a member of the Board of Directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee’s primary responsibilities are (i) assist our Board of Directors in identifying prospective director nominees and recommending nominees for each annual meeting of the stockholders to the Board of Directors, (ii) review developments in corporate governance practices and developing and recommending governance guidelines, code of conduct, and compliance mechanisms applicable to the Company, (iii) provide ongoing review of risk performance and exposure company-wide in the enterprise risk categories including operational, technological, compliance, reputational and political (it being understood that the Audit Committee will provide ongoing review of financial risk management categories), and (iv) ensure

| Corporate Governance and Nominating Committee | |||

| • | Identify and recommend nominees for the Board | Number of Meetings in 2014: | |

| • | Monitor and develop our corporate governance practices, guidelines, code of conduct and compliance mechanisms | 5 | |

| • | Review risk performance and enterprise risk exposure across operational, technological, compliance, reputational and political areas | Committee Members: | |

| • | Oversees the Company’s legal and regulatory compliance | O’Hara (C, I) Browning (F, I) Davis (I) Olsen (I) | |

| • | Monitor the existence and capability of risk management systems and control in all critical business activities and enterprise risk categories | ||

The Committee will evaluate each nominee based upon a consideration of a nominee’s qualification as independent and consideration ofas well as their diversity, age, skills and experience in the context of the needs of the Board of Directors as described in our Corporate Governance Guidelines. The Corporate Governance and Nominating Committee may rely on various sources to identify director nominees. These include input from directors, management, professional search firms and othersother sources that the Committee feels are reliable.

Stockholders may recommend director candidates for consideration by the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee, which will consider such suggestions made by stockholders in the same manner as other candidates. Any such suggestions should be submitted to the Chairman of the Corporate Governance and Nominating Committee, c/o William Sutton, Senior Vice President, General Counsel and Corporate Secretary, RigNet, Inc., 1880 S. Dairy Ashford, Suite 300, Houston, Texas 77077-4760. The written request must include the candidate’s name, contact information, biographical information and qualifications. The request must also include the potential candidate’s written consent to being a nominee and to serving as a director if nominated and elected. AdditionalThe Committee may request additional information may be requested from time to time by the committee from the nominee or the stockholder or group of stockholders. Stockholder nominations that seek to bypass the consideration of the Corporate Governance and Nominating Committee must follow the procedures set forth in our bylaws, which are summarized below in the Section entitled “Stockholder Proposals and Nominations for the 20152016 Annual Meeting of the Stockholders.Meeting.”

In 2013, the Corporate Governance and Nominating Committee held 5 meetings. The Corporate Governance and Nominating Committee is currently comprised of four directors: Messrs. Neveu (Chairman), Browning, Davis and Olsen, who are all “independent”, as defined by the NASDAQ listing standards. Upon the expiration of Mr. Neveu’s term as a director at the Annual Meeting, he will cease to be a member of the Corporate Governance and Nominating Committee.

Corporate Development Committee

The Corporate Development Committee assists our Board of Directors in providing oversight and guidance to our management related to (i) the evaluation of corporate development opportunities and (ii) strategies and processes regarding merger and acquisition initiatives. During 2013, the Corporate Development Committee held 7 meetings. The Corporate Development Committee is currently comprised of five independent directors: Messrs. Davis (Chairman), Caprioli, de Vibe, Mulloy and Whittington.

| Corporate Development Committee | |||

| • | Provide oversight and guidance for the evaluation of corporate development opportunities | Number of Meetings in 2014: | |

| • | Provide oversight and guidance over the strategies and processes regarding merger and acquisition initiatives | 5 | |

| Committee Members: | |||

Mulloy (C, I) Caprioli (I) | |||

Report of the Audit CommitteeREPORT OF THE AUDIT COMMITTEE

The Audit Committee oversees the financial reporting process of the Company on behalf of its Board of Directors. Management has the primary responsibility for the preparation of the financial statements and the reporting process, including the systems of internal control.

With respect to the financial statements for the year ended December 31, 2013,2014, the Audit Committee reviewed and discussed the financial statements of RigNet, Inc. and the quality of financial reporting with management and the independent auditor. The Audit Committee received the written disclosure and the letter from the independent auditor required under applicable requirements including Auditing Standard No. 16,Communication with Audit Committees, as established by the Public Company Accounting Oversight Board. Additionally, the Audit Committee has discussed with the independent auditor their independence with respect to the Company. The Audit Committee determined that the non-audit services provided to RigNet by the independent auditor (discussed below under “Proposal Two: Ratification of Independent Public Accountants”) are compatible with maintaining the independence of the independent auditor.

Based on the reviews and discussions described above, the Audit Committee recommended to our Board of Directors that the financial statements of RigNet, Inc. be included in the Annual Report on Form 10-K for the year ended December 31, 20132014 for filing with the SEC.

| Submitted By: | |

| Audit Committee | |

| James H. Browning, Chairman | |

| Kevin Mulloy | |

| Brent K. Whittington |

This Report of the Audit Committee is not “soliciting material” and shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or under the Securities Act of 1934, as amended, except to the extent the Company specifically incorporates this report by reference, and shall not otherwise be deemed filed under such Acts.

Thefollowing summarizes the compensation of each non-employee member of our Board of Directors for the fiscal year ended December 31, 2013.2014. Our CEO also is also a board member.Since he is an employee of the Company, he does not receive additional compensation specifically related to his service on our Board of Directors. In addition, Mr. Caprioli does not receive any compensation for his role as a member of our Board of Directors due to his affiliation with KKR, a holder of over 25% of our outstanding shares of common stock.

OurBoard of Directors has implemented a compensationpolicy applicable to our non-employee directors, which provides those directors the following compensation for boardBoard and committee services:

| • | an annual retainer paid in cash in an amount equal to $9,000 per quarter; |

| • | annual equity awards of restricted stock in an amount to be approved by the Board or, at the option of our Company, an equivalent payment in cash; |

| • | $1,500 for each Board meeting attended in person if traveling within North America or telephonically or $4,500 for each meeting attended in person if traveling from outside North America; and |

| • | $1,000 for each committee meeting attended. |

In addition, this compensation policy provides that thechairman of the Audit Committee will receive an additional annual retainer of $15,000; the chairman of our Auditthe Compensation Committee will receive an additional annual retainer of $10,000; the chairman of the CompensationCorporate Governance and Nominating Committee will receive an additional annual retainer of $7,500;$10,000; the chairman of the Corporate Governance and Nominating committeeDevelopment Committee will receive an additional annual retainer of $5,000; the chairman of the Corporate Development committee will receive an additional annual retainer of $5,000;$10,000; and the non-executive chairman of the Board of Directors will receive an additional annual retainer of $50,000.$50,000. Retainers and meeting fees are paid at the end of each quarter on a pro rata basis for any partial service periods.

Thefollowing table summarizes the compensation of each non-employee member of our Board of Directors in 2013:2014:

Name (1) | Fees Earned or Paid in Cash (2) | Stock Awards (3) (4) | Total | Fees Earned or Paid in Cash (2) | Stock Awards (3) | Total | ||||||||||||||||

James H. Browning | $ | 120,000 | $ | 49,691 | $ | 169,691 | $ | 120,014 | $ | 153,892 | $ | 273,906 | ||||||||||

Mattia Caprioli | - | - | - | - | - | - | ||||||||||||||||

Charles L. Davis | 73,000 | 49,691 | 122,691 | 59,778 | 153,892 | 213,670 | ||||||||||||||||

Ditlef de Vibe | 70,000 | 49,691 | 119,691 | 65,000 | 153,892 | 218,892 | ||||||||||||||||

Kevin Mulloy | 60,000 | 49,691 | 109,691 | 62,456 | 153,892 | 216,348 | ||||||||||||||||

Kevin Neveu | 64,500 | 49,691 | 114,191 | |||||||||||||||||||

Kevin J. O’Hara | 58,959 | 49,691 | 108,650 | 64,343 | 153,892 | 218,235 | ||||||||||||||||

Keith Olsen | 68,500 | 49,691 | 118,191 | 66,139 | 153,892 | 220,031 | ||||||||||||||||

Brent K. Whittington | 61,000 | 49,691 | 110,691 | 56,000 | 153,892 | 209,892 | ||||||||||||||||

| Kevin Neveu | 21,536 | 48,255 | 69,791 | |||||||||||||||||||

| (1) | Each non-employee director listed above served as a director for all of |

| (2) | Amounts reflect annual retainers and |

| (3) | Reflects the aggregate grant date fair value for restricted stock granted in |

The table above reflects all compensation received by our independent directors during 2013.

| 14 |

OUR EXECUTIVE OCompensation DiscussionFFICERS

The following table provides information regarding our executive officers.

| Name | Age | Position with Our Company |

| Mark B. Slaughter | 56 | Chief Executive Officer and President |

| Martin Jimmerson | 51 | Senior Vice President and Chief Financial Officer |

| William Sutton | 61 | Senior Vice President, General Counsel & Corporate Secretary |

| Hector Maytorena | 54 | Group Vice President, Managed Services |

| Morten Hagland Hansen | 42 | Senior Vice President, Business Services and Chief Technology Officer |

| Gerry Gutierrez | 52 | Group Vice President, Telecommunications Systems Integration |

Mark Slaughter has served as our Chief Executive Officer and AnalysisPresident since August 2007. See his biographical summary presented earlier in this proxy statement under the heading “Our Board of Directors and Nominees – Director Nominees.”

Martin Jimmerson has served as our Senior Vice President and Chief Financial Officer since February 2014 and our Chief Financial Officer from November 2006 through January 2014. Prior to that, Mr. Jimmerson served as Chief Financial Officer for River Oaks Imaging & Diagnostic, LP from November 2002 to December 2005. Mr. Jimmerson received a B.A. degree in accounting from Baylor University.